Back to Home & Heritage overview

Home & Heritage Attitudes

In this section

Priorities

Over three quarters of this group identifies with the arts and has time to spend enjoying venues, if the facilities are welcoming and accessible.

- Like most segments, they are broadly positive about arts and culture, do see themselves as arts-attenders and value the arts in general, with only 26% feeling that “the arts is not for them”.

- They feel particularly that heritage is an important contributor to sense of place and believe in the conservation of local heritage sites.

- This group is almost exclusively retired or semi-retired so have time to spend, and safe, pleasant and formally welcoming environments are highly valued - a quality café or restaurant may form a key part of the appeal.

- Level access, large-print, captioning and other access facilities are enormously important, with just over half of this group declaring a disability.

Spending

This group values the price on the tin, rather than premium offers or transient discounts, though all-in elders packages can appeal, as long as transparent.

- Although living on modest incomes, Home & Heritage are comfortable – neither bargain discounting nor premium pricing are likely to appeal.

- Value, all-in pricing or senior packages/offers may have a particular appeal.

- They appreciate unfussy transparency to which they can apply rational decision-making: this preference should inform pricing.

Cost-of-living concerns

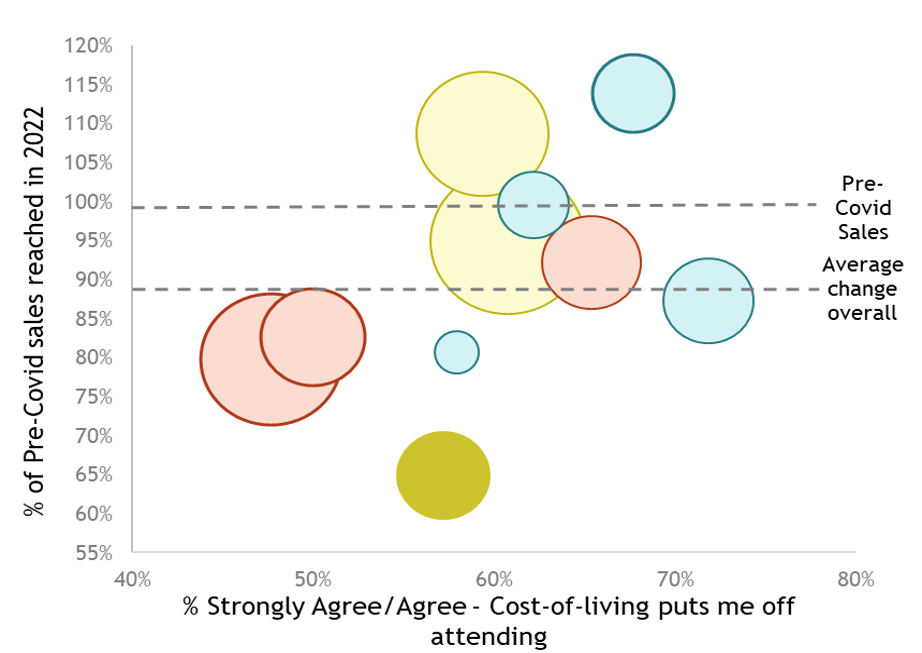

Home and Heritage is the segment whose attendance has bounced back the least post-Covid-19, meaning that, whilst they are not as put off by the cost-of-living as some, they are unlikely to be audiences to rely upon through this latest crisis.

Around a quarter of this segment strongly agreed with statements about inflation and energy cost changes affecting cultural spend. However, only 14% expect interest rates to impact spending, which we'd expect was due to lower proportions having mortgages at this life stage.